Surest Flex and flexible coverage.

In any given year, most of us won’t need a knee replacement or carpal tunnel surgery. But for those of us on the Surest Flex plan who choose to have a plannable, non-emergency procedure, there’s an additional step to take: activating flexible coverage. This means coverage must be activated at least three business days before treatment occurs. (Activation isn’t required for emergencies or when related to cancer treatment.)

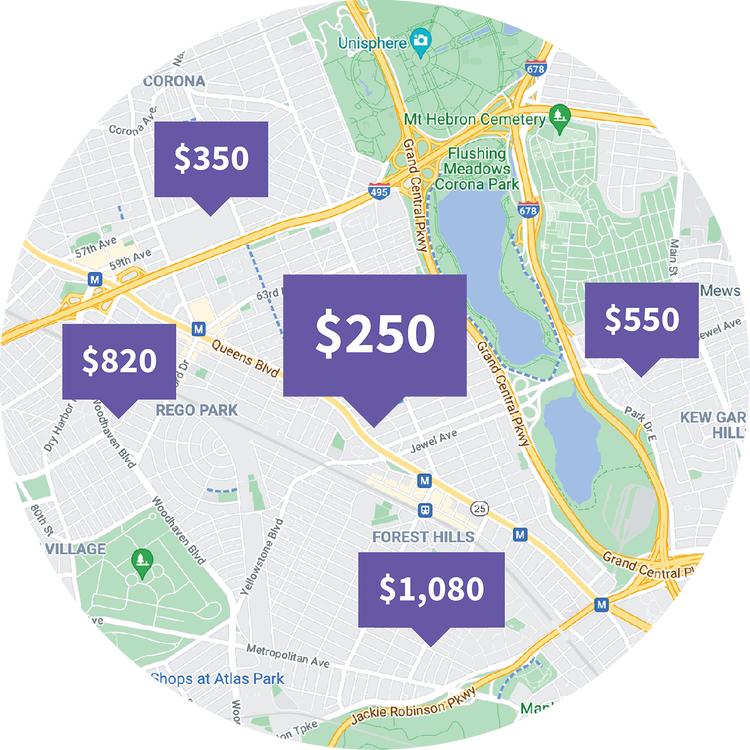

Check Costs, Compare Care Options

Use the Surest app or website to search for a doctor, treatment, or procedure, see what you’ll owe before making an appointment, compare costs and care options, then decide what works best for you.

How to activate coverage

- Search your procedure or treatment in the Surest app or website. Can’t find what you’re looking for? Call Surest Member Services.

- You'll see different provider and cost options.

- Select your service location and activate the coverage at the identified cost.

- You'll receive an email confirming coverage has been activated.

Activation checklist:

- You must activate coverage at least three business days before treatment occurs.

- While you're discussing the treatment or procedure with your doctor, ask them for the CPT code. For example, "knee reconstruction" will not show up in a search, but "knee arthroscopy" will.

- Ensure you have the correct address for the surgery location (this is NOT your doctor's office — it's where the surgery or procedure will take place). Make sure you have the correct location selected when activating coverage. If the location doesn't appear when searching, call Surest Member Services to confirm.

- Confirm whether the treatment or procedure will be billed as inpatient or outpatient.

Frequently Asked Questions

What does it mean to activate flexible coverage?

The Surest Flex plan includes the flexibility to activate flexible coverage for a small list of less common, plannable treatments and procedures (think: knee replacement); if and when you need it — simply activate the coverage for your preferred provider at least three business days in advance of receiving the care.

Can I activate coverage after I’ve received treatment?

No. You can’t activate flexible coverage for a treatment or service you’ve already received because insurance coverage doesn’t work in reverse. Call Surest Member Services if you have questions about how to activate flexible coverage.

If I choose to activate coverage, what is included?

For details regarding flexible coverage, use the Surest app or website. Procedure-day anesthesia, the procedure itself, and same-day aftercare are all typically included. Some related services outside the service date or location (e.g., pretreatment imaging and diagnostics) might not be included.

Why do prices differ for the same treatment?

Providers that Surest has evaluated as higher-value are assigned a lower copay, accounting for quality, efficiency, and overall effectiveness of care.

Can I pay for activated coverage in one lump sum?

When you activate flexible coverage, the process incurs an additional paycheck deduction in addition to a price (copay) you pay directly to the provider.

When can I activate flexible coverage?

Activate coverage at any time throughout the plan year, at the time of need. It’s important to activate the coverage at least three business days in advance of receiving the care.

I activated coverage by mistake, can I cancel?

Once you activate coverage, you can cancel the activation within three business days. Call Surest Member Services for assistance.

What if my provider determines that the procedure is no longer needed?

It's important you confirm the need for the treatment or service with your provider before you activate flexible coverage. Once you activate the coverage, you have a window of three business days to cancel it. Call Surest Member Services if you have flexible coverage questions.

Can I activate coverage for someone else on my plan?

The primary member — the individual who receives the Surest health plan through their employer — can activate coverage for themself or for covered dependents. A dependent can independently request to activate flexible coverage. However, that request is sent to the primary member for final approval. (This approval process ensures the primary member, who would incur expenses, has an opportunity to review and approve in advance.)