What to know about the Surest plan when choosing insurance.

You asked, we answered: Your top questions about the Surest plan

Whether you’re an employee considering the Surest plan for the first time, or you’ve been a member for a while, we compiled a list of common questions about the Surest health plan.

I'm relatively healthy. Why do I even need health insurance?

Anyone, of any age, can slip or fall, get in an accident, or become sick enough to need a doctor. Without coverage under a health insurance plan, the high cost of treatment can be catastrophic. According to the White House Office of Intergovernmental Affairs, National Economic Council, and Domestic Policy Council, “one in three adults, nearly 100 million Americans, struggle with unpaid medical bills.” As reported by the American Journal of Public Health, medical debt is the leading cause of bankruptcy.

With health insurance, your insurer takes on the risks of protecting you from the unexpected. You pay a premium out of your paycheck in exchange for this protection, or insurance.

And people with health insurance are more likely to visit the doctor regularly for annual checkups, taking care of little issues before they become more serious down the road.

Check out our post for a detailed look at how health insurance works.

How does the Surest plan work?

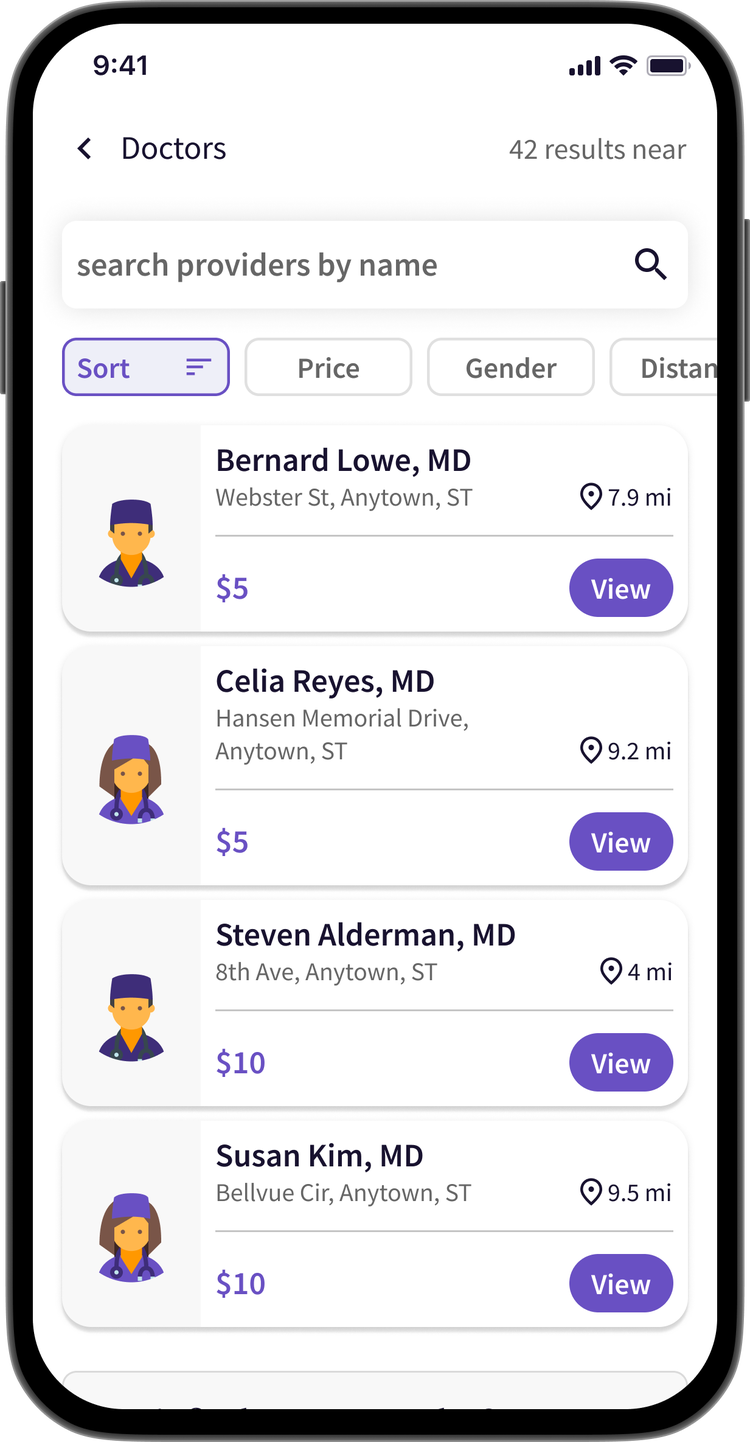

Surest is a no-deductible health plan where you can see prices before making an appointment. You can compare and plan ahead. Even better, prices are lower for providers evaluated as higher-value options, based on quality, efficiency, and overall effectiveness of care. In other words, providers who may help you feel better, faster, typically cost less. With the Surest plan, you have options to choose differently. Read more on how Surest is different.

What network is used?

Surest accesses the national UnitedHealthcare provider network. You will likely pay less for care when choosing in-network providers vs. those that are out-of-network.

Is there a deductible or coinsurance?

No, with the Surest plan, there is no deductible or coinsurance. It’s one of many ways Surest is different from other health plans.

What’s the big deal about being able to see prices up front?

Price transparency is another reason Surest is so different. You can see prices before you make an appointment or fill a prescription, compare options, then decide what works best for you. With many other plans, you don’t see what you’ll owe until after you go to the doctor and receive a bill in the mail.

What does the Surest plan cost?

You pay for the Surest plan through regular payroll deductions, or premiums. Your premium is the monthly amount you pay to have health insurance coverage, just as you would pay any monthly bill or subscription.

You can find the actual deductions on your company’s benefits site. When you receive care, there will also be a copayment associated with the service you receive. With Surest, you can look up those prices in advance and find more opportunities to save. The prices, too, are grouped together, so you pay one price for a single care event (including labs and basic tests).

What is a copayment?

Copayments, often known as “copays” for short, are specific dollar amounts you pay for using routine services — like a doctor’s visit or picking up a prescription —defined by your health plan. You pay these prices until you hit a specified amount in health care spending. This specified amount is factored into your out-of-pocket limit. If you’re considering the Surest plan during open enrollment, you can look up your copays on Join.Surest.com. If you’re a current member, visit the Surest app or website.

Will I owe more than the copay?

No, the copay is the full amount you owe for care received from an in-network provider. The Surest plan pays the amount above the copay directly to the provider.

Is there an out-of-pocket (OOP) limit?

Yes. There’s an OOP limit, or the most you’ll pay in copays — a “cap” — during a given year. Once you hit this number, you won’t owe for covered services for the remainder of the year, presuming you stay in-network. (Monthly premiums and out-of-network expenses don’t count toward out-of-pocket limits.)

What does the Surest plan cover?

The Surest plan covers:

- Preventive care (your annual checkup, some health screenings, vaccinations)

- Primary and specialty care

- Maternity care

- Mental and behavioral health services

- Hospital services

- Urgent and emergency services

- Cancer care

- Treatment for chronic conditions

- Substance use disorders

- Most diagnostic testing (ultrasounds and bloodwork)

- Durable medical equipment

- Prescription drugs

- And more

If you’re considering the Surest plan (and your employer is offering it), check costs and coverage at Join.Surest.com. If you’re already a member, download the Surest app. You can also call Member Services at the number on the back of your Surest ID card for clarification around cost, coverage, claims, or what your benefit includes.

How does Surest work when it comes to accidents, catastrophic events, and/or unexpected illnesses?

The Surest plan includes coverage for emergency care. If the emergency room visit results in a hospital stay, you are covered for the hospital stay as well.

Is preventive care covered?

Yes, the Surest plan covers preventive care. Preventive services include vaccinations, routine screening tests, and provider visits. If you also receive non-preventive services during the same visit, you might pay for that service separately.

What types of services are not covered under the Surest plan?

Services that are not medically necessary or considered cosmetic might not be covered under the Surest plan.

How can I determine if something isn’t covered?

If no results appear when you search, give Member Services a call at the number on the back of your Surest member ID card for clarification/confirmation.

Do I need prior authorization with the Surest plan?

There are some services, surgeries, procedures, and medications that might require prior authorization on the Surest plan. Prospective members can search on Join.Surest.com or, if you’re a current member, search on the Surest app or website for the specific service. You’ll not only see the price for that service, but also other requirements, like prior authorization.

Does the Surest plan cover telehealth and virtual visits?

Yes, Surest covers telehealth and virtual visits, typically with a copay. An e-visit or virtual visit with an in-network provider you might normally see in-person would likely be the same copay as an in-person office visit with that provider.

How do I find which prescription medications are covered?

You can find prescription medications on the drug formulary, or list of covered drugs. You can search on Join.Surest.com (before you become a member) or on the Surest app or website (once you become a member) for exact details. If a brand drug isn’t covered, you’ll find an available generic equivalent.

What should I do if my provider doesn’t recognize Surest?

Surest accesses the UnitedHealthcare provider network and Optum Behavioral Health but is NOT the same as UnitedHealthcare. There are different payer IDs. For Surest, claims should be submitted to Payer ID 25463. Providers can confirm eligibility through UHCprovider.com.

Am I covered when traveling anywhere in the country? Even in an emergency? Are my out-of-state college kids covered?

Yes. Surest utilizes the broad, national UnitedHealthcare provider network, with providers and services in all 50 states.

Am I covered for international travel?

With the Surest plan, you have emergency medical coverage outside the United States. Any emergency care received overseas is a cost to you, and you’ll need to submit a claim for reimbursement upon returning to the U.S.

Do I have coverage for cancer care?

Yes. See more details on our cancer member guide.

Do I have coverage for chronic conditions?

Yes. See more details on our chronic conditions member guide.

Do I have coverage for mental health?

Yes. Check out our mental health member guide.

How does the maternity benefit work?

Surest offers comprehensive maternity coverage including prenatal, delivery, and postnatal care. There’s a delivery copay range, depending on the in-network hospital or birth center at which you plan to have your baby. This price covers all standard care that occurs including provider fees, facility fees, routine labs and tests, routine newborn care, episiotomy, epidurals, and medications as long as Mom and baby are discharged at the same time. Check out our maternity guide for more information. In the event that the baby is not discharged with their parents and needs to spend some additional time in the NICU, there would be an inpatient hospital copay for the baby’s NICU stay.

How are prices determined?

At Surest, we recognize that not all doctors and facilities are the same. We believe providers with better outcomes should cost less. Providers should be rewarded for helping people get better faster and stay better longer. Explore how Surest assigns prices.

Ready to learn more?

Contact your employer’s benefits department. If you’re not a member, we’d love to have you join us!

1Surest 2021 members enrolled 12 months, medical and pharmacy claims. 82_V03

2 https://www.whitehouse.gov/briefing-room/statements-releases/2023/12/08/readout-of-the-white-house-state-convening-on-medical-debt/#:~:text=One%20in%20three%20adults%20%E2%80%93%20nearly,they%20need%20to%20get%20by.